Features

The most customizable and feature packed divergence indicator on TradingView

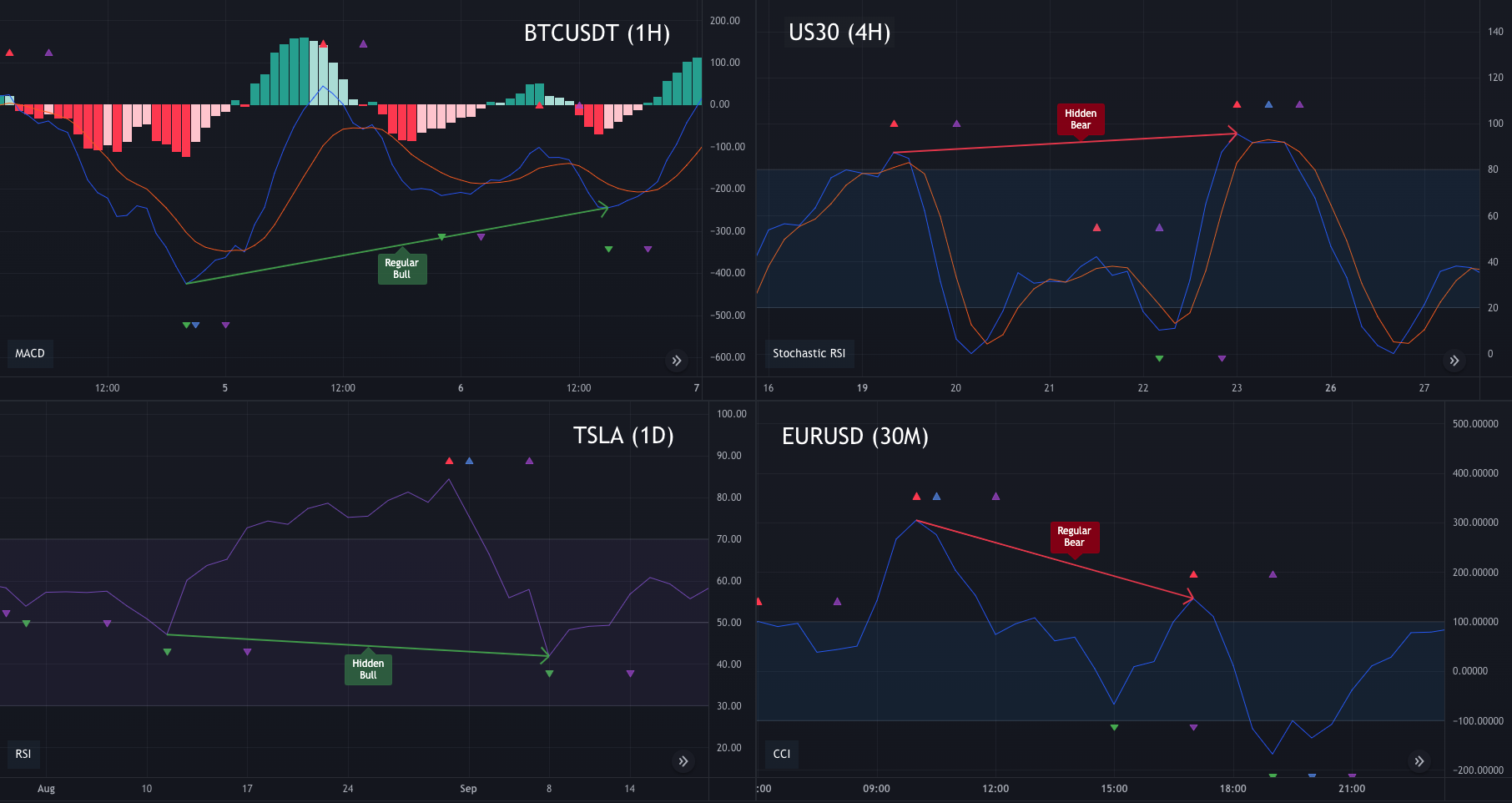

Divergence detection for any market & any timeframe

Do you scalp cryptocurrencies? Swing trade Forex? Perhaps you are a long term stock investor? Not a problem. The Divergent can alert you of the presence of divergences on any market and any timeframe.

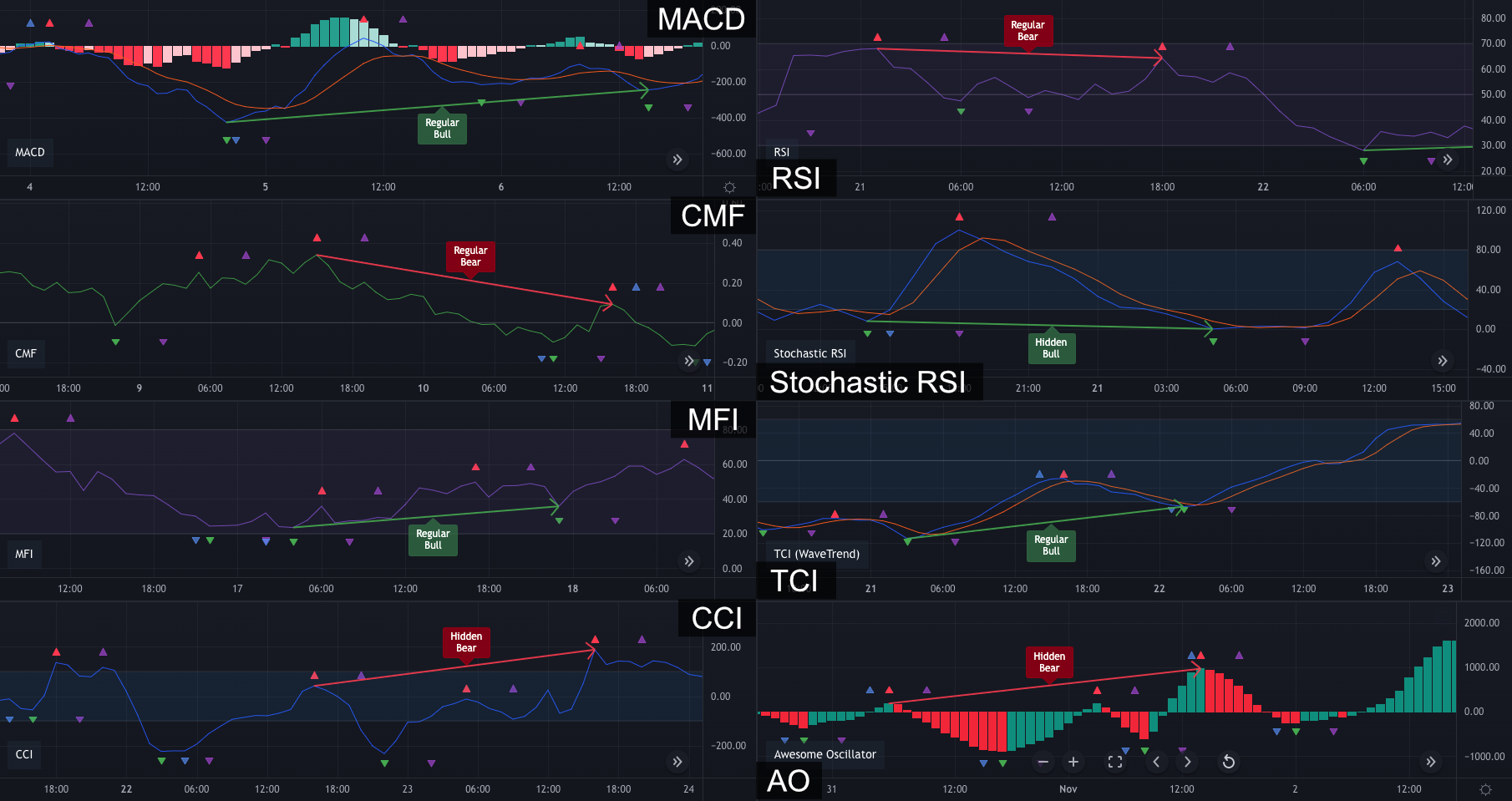

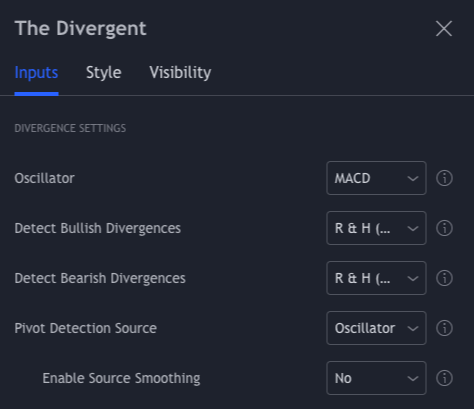

Choose from several built-in oscillators

Do you have your favorite oscillator to detect divergences on? We've got you covered. The Divergent comes with 9 oscillators out of the box: MACD, RSI, CMF*, Stochastic RSI*, MFI*, TCI (WaveTrend)*, Balance of Power*, CCI* and the Awesome Oscillator*.

*: Pro feature

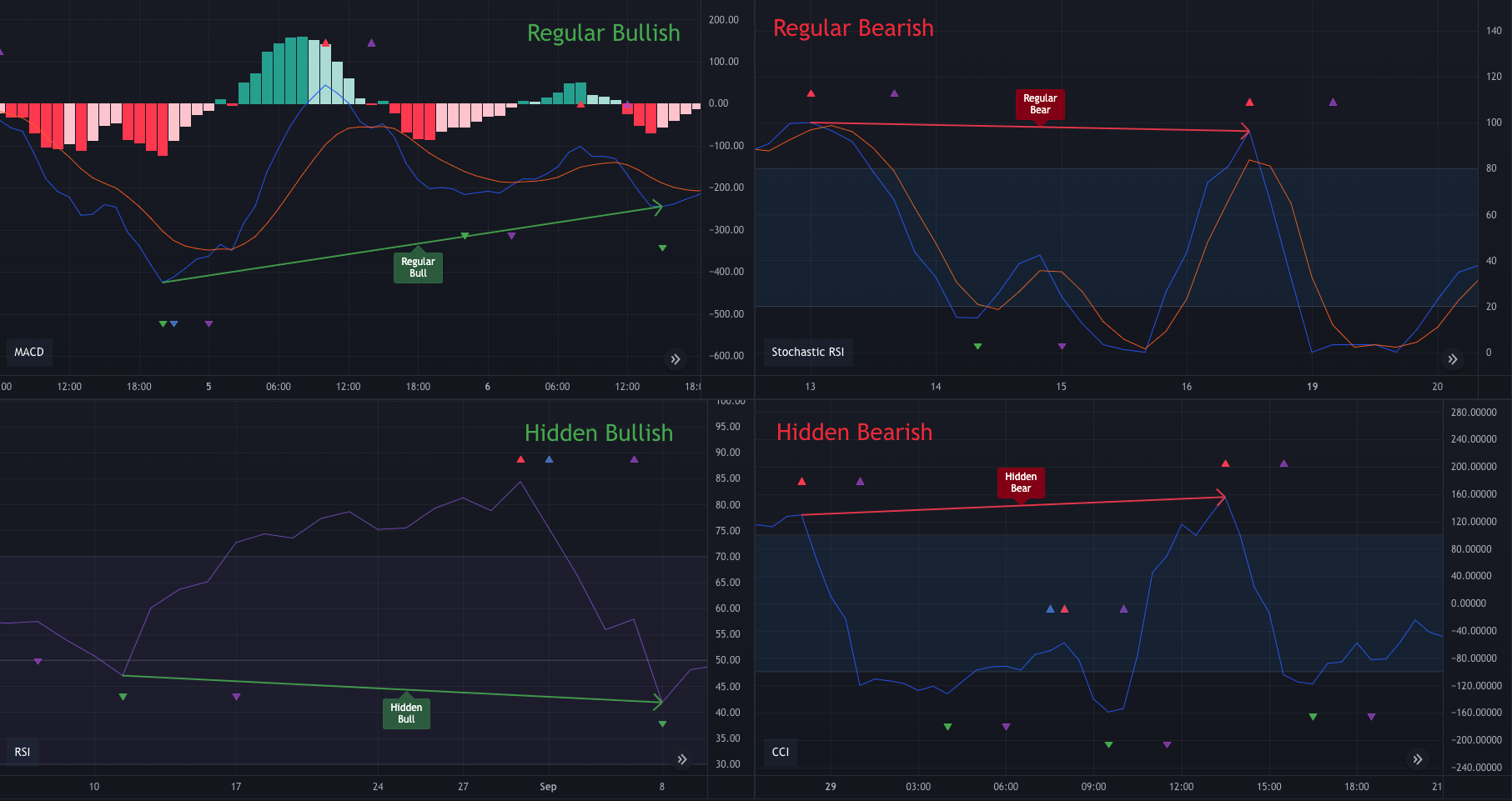

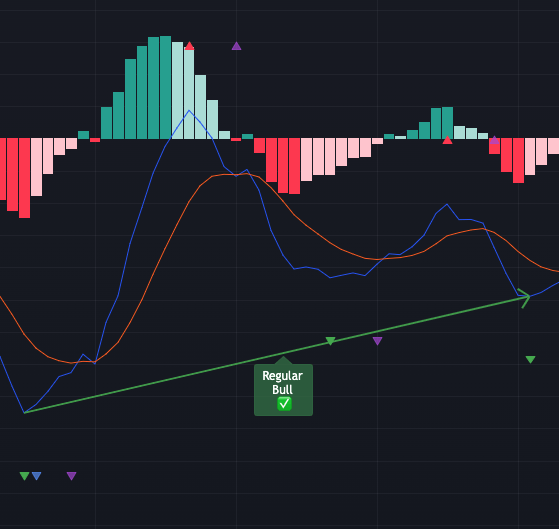

All types of divergences supported

The Divergent will alert you of any of the four divergences that present itself on your chart: Regular Bullish, Hidden Bullish*, Regular Bearish and Hidden Bearish*. You are free to cherry pick the ones you are interested in.

*: Pro feature

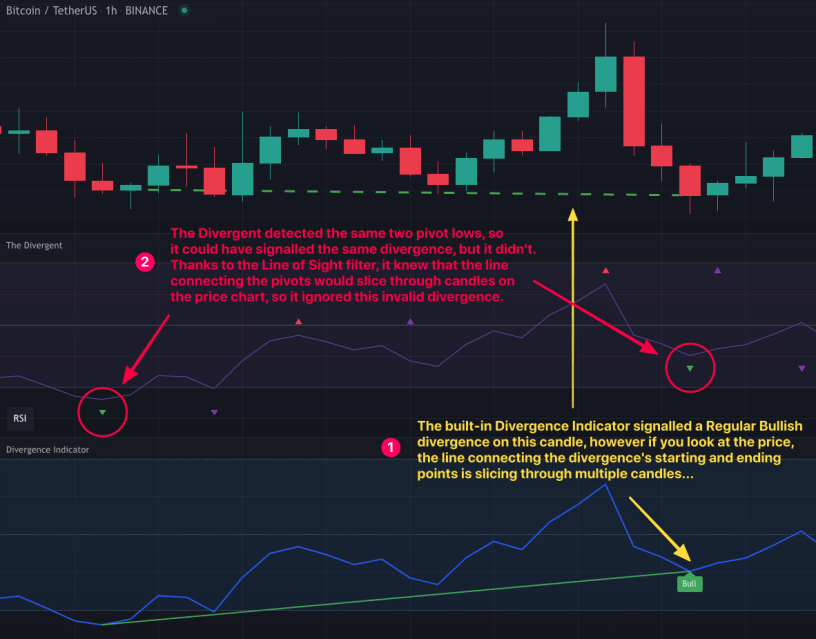

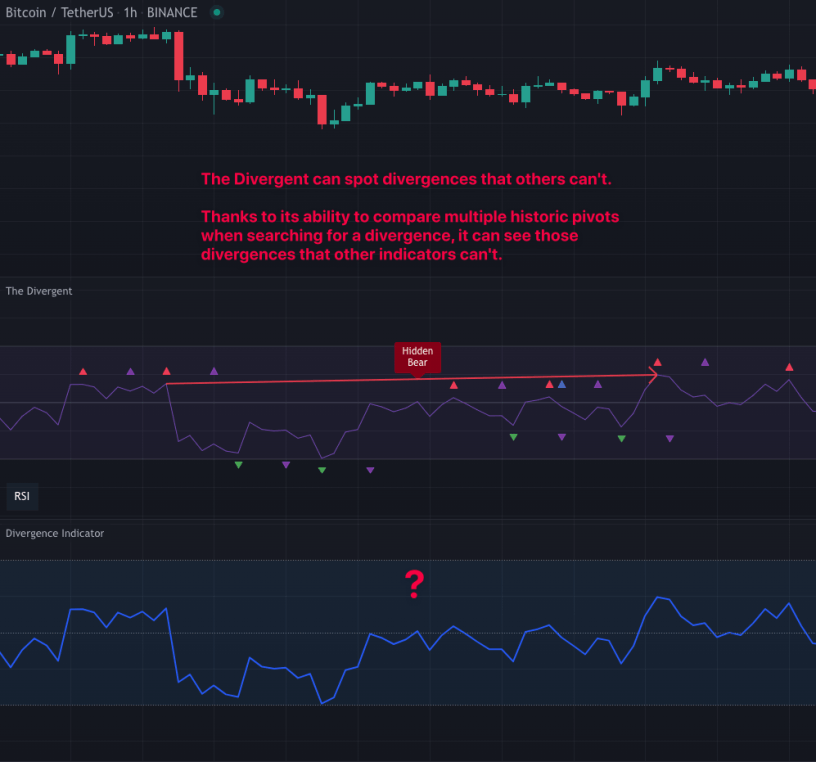

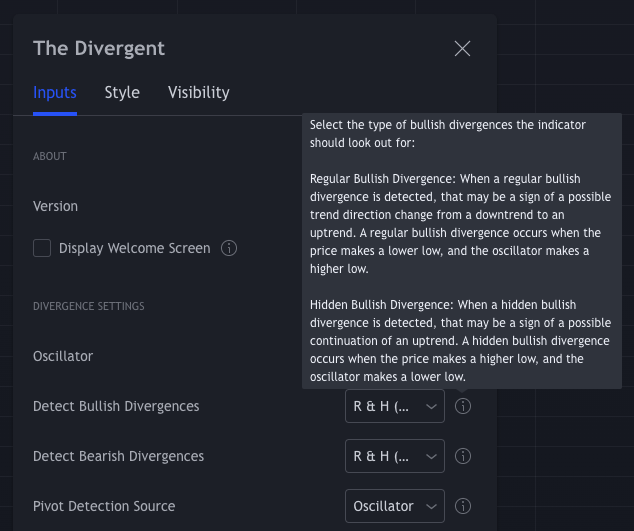

You have complete control over every aspect of divergence detection

Do you normally draw your divergence lines on the wicks of the candles? Perhaps on the candle bodies? Do you think a divergence is only valid if the line connecting the candles is continuous and uninterrupted? You can customise all of this, plus a lot more, using the 20+ configuration options available in the indicator settings. When fully configured, The Divergent will only signal those divergences that you personally think it is worth paying attention to.

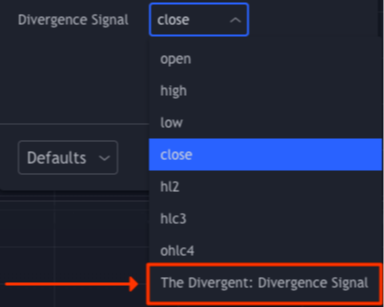

Ready to be integrated into strategies (Pro feature)

Are you a Pine Script developer who wishes to use divergences as one of the entry condition in your own strategies? Look no further. The Divergent can be used as a DaaS (Divergence as a Service)! Just add The Divergent onto the same chart as your strategy, add an input with "input.source" to the strategy code, and select the "Divergence Signal" as the input's source. Every time a divergence is detected, your strategy will receive a signal, so you can have your long entries only be made if there was a Regular Bullish divergence detected recently!

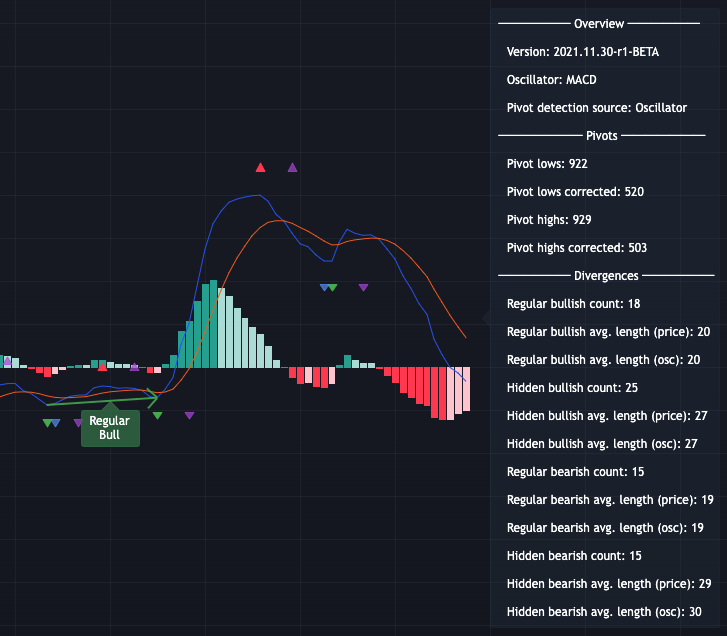

Divergence statistics

The Divergent comes with a built in widget that shows you various statistics about the detected pivots and divergences, like the number of detected divergences in a given period, or how many times a divergence correctly predicted a change in price. You can use these numbers as a feedback when tweaking the indicator to give you the best possible signal.

Divergence lines on both the price and the oscillator

(Pro feature)

The Divergent comes with a companion indicator, which can be used to display divergence lines and labels on the price chart itself. The two indicators are linked together in an innovative way, which means you only have to configure one indicator (The Divergent); the companion indicator will automatically reconfigure itself and draw the lines on the correct candles.

Divergence quality control

(Pro feature)

With divergence verification enabled, The Divergent will tell you how many times a particular divergence "worked out", i.e. how many times a bullish or bearish divergence has actually resulted in the change in price in the direction predicted by the divergence. You can configure the price % levels which is used to categorise the divergences as winners or losers.

Fully documented

The Divergent has over 25 options available to tweak, and each of them comes with a mini documentation built inside the indicator, so that you can make an informed decision whether something is worth enabling or not. If you don't find an answer in the tooltips, you will appreciate the fact that The Divergent also comes with a 45+ page PDF document, where the inner workings of the indicator is explained in great detail.